Check Vehicle Insurance Status Online in India

In India, vehicle insurance is legal requirement under the Motor Vehicles Act, 1988 is not just a financial safeguard. Ensuring your vehicle has valid insurance protects you from damage costs. Check your vehicle insurance status regularly help timely renewals and accident-related claims.

To verify your vehicle insurance status follow these both details online and offline.

Online Methods to Check Vehicle Insurance Status

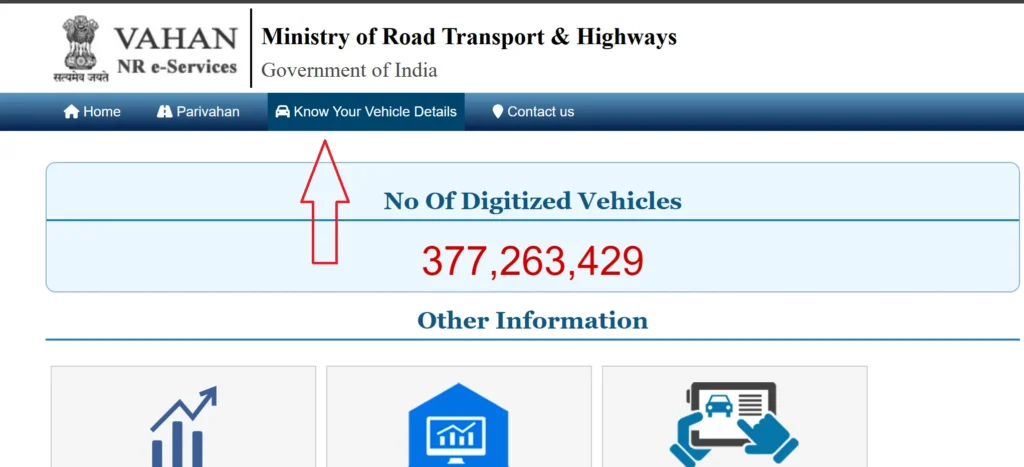

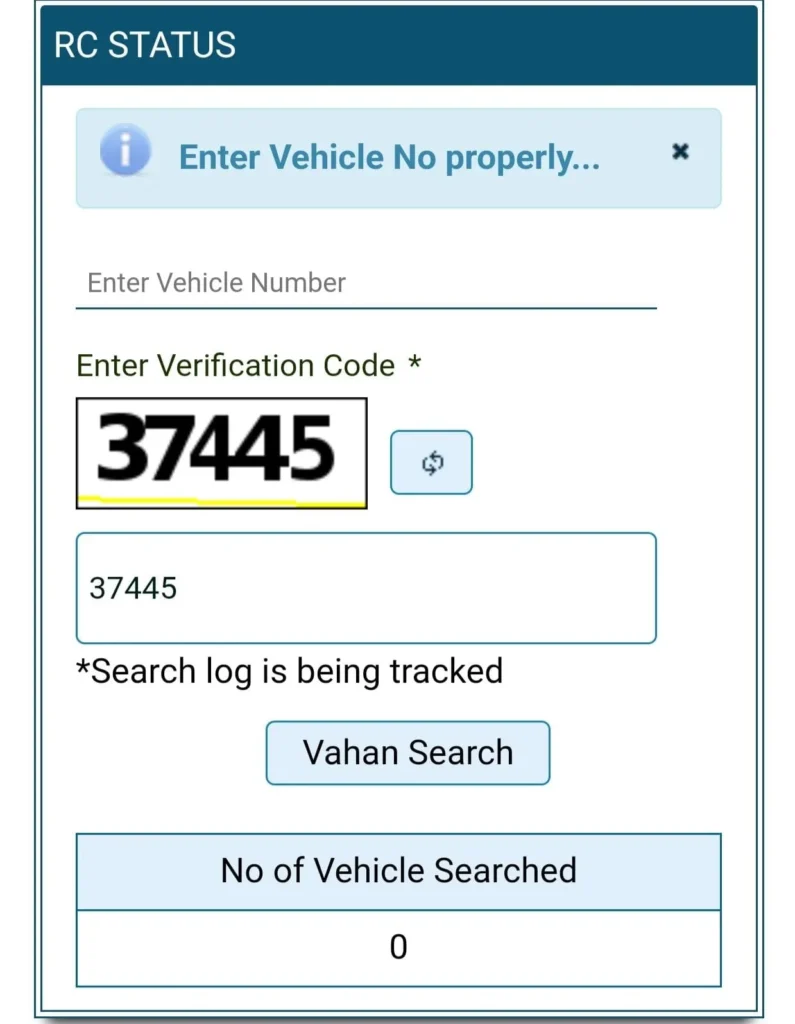

1. V A H A N | National Register e-Services

A official platform by the Ministry of Road Transport & Highways store vehicle dats. Follow these steps:

Note

RTO verification is needed in uncomplete data and requires registration number.

2. Insurer’s Website or App

To manage insurance use online portals or mobile apps. Follow these steps:

Popular Insurers:

- Bajaj Allianz: bajajallianz.com

- Reliance General: reliancegeneral.co.in

- Tata AIG: tataaig.com

Offline Methods to Check Vehicle Insurance Status

1. Visit the Regional Transport Office (RTO)

RTOs maintains insurance details or vehicle records. Follow these steps:

Documents Needed:

- Vehicle registration certificate (RC)

- Identity proof

- Insurance policy copy (if available)

2. Contact Insurance Provider

Contact your insurer foe detailed information. Below steps helps you:

3. Visit an Insurance Agent or Broker

If policy buy through agent ask him to check policy status:

Tips for Insurance Status Checks

- Details Required: Policy number, vehicle registration number, chassis/engine number.

- Check Expiry Date: To avoid penalties renew policies on time.

- Verify accuracy: For correct data use (Parivahan portal and insurer portal).

- Careful from Fraud: Use verified contact number and websites.

Difference Between First-Party and Third-Party Vehicle Insurance

Vehicle insurance in India is financial security of your vehicle. Third-party insurance cover damages to other under mandatory under the Motor Vehicles Act, 1988 or first-party insurance protects the policyholder vehicle.

| Feature | First-Party Insurance | Third-Party Insurance |

|---|---|---|

| Coverage | Policyholder and their vehicle | Third parties (others’ property/people) |

| Scope | Own-damage (accidents, theft, fire, natural disasters) | Damages/injuries caused by your vehicle |

| Legal Requirement | Optional | Mandatory (Motor Vehicles Act, 1988) |

| Exclusions | Third-party damages | Policyholder’s vehicle damage |

| Example | Repairs for your car after a crash | Compensation for hitting another car |

Types of Vehicle Insurance Policies

- Comprehensive Insurance: First-party and third-party coverage Protects your own-damage and third-party.

- Standalone Own-Damage (OD) Insurance: Cover only policyholder vehicle.

- Pay-As-You-Drive Insurance: Premium based on kilometers driven. Best for low-usage vehicles.

- Bundled Policies: Combination of third-party and own-damage for new vehicles (up to 3 years for two-wheelers and 1 year for four-wheelers.

Penalties for Driving Without Valid Insurance

Driving without valid insurance is illegal under the Motor Vehicles Act, 2019. Penalties include:

- First offence: ₹2,000 fine and/or up to 3 months imprisonment.

- Second offense: ₹4,000 fine and/or up to 3 months imprisonment.

Claim Process

- Inform Insurer immediately after incident.

- File FIR for accidents, theft or third-party claims.

- Attach documents policy copy, RC, DL, FIR, repair bills.

- Insurer verify damage for approval.

For more details, visit IRDAI or contact your insurer.